Why haven’t we heard about BlackRock’s Aladdin?

The AI at the top of the World’s Pyramid – ALADDIN’s 5,000 supercomputers now act as the central nervous system for the world’s most sophisticated investors and asset managers.

The reason why BlackRock is so efficient in influencing governments around the world is because ‘ALADDIN’s’ extensive technology program operates more than $21.6 trillion in assets.

ALADDIN

- Asset

- Liability

- And

- Debt and

- Derivative

- Investment

- Network

This Robot Already Owns Everything (And it’s just getting started) : BlackRock ALADDIN

30 Nov 2021 YouTube | Rumble-Mirror | Download on Telegram

Source: Roger James Hamilton https://www.rogerjameshamilton.com/

This is the story of ALADDIN, and how it – and BlackRock – took over Wall Street.

BlackRock has a secret weapon that has made it the most powerful company in the world: ALADDIN. If you’re ever wondered how Artificial Intelligence could impact our lives, here’s the answer. ALADDIN is the brainchild of Larry Fink, and it already controls more assets than the GDP than the US. It’s growing by $1 trillion to $2 trillion new assets in its control each year.

What if I told you there is a robot that controls more wealth than any country on earth? A robot so powerful that in the last 10 years it has quietly created the biggest company in the world.

This is the story of a robot called ALADDIN. It’s Wall Street’s best kept secret and it’s gobbling up every asset class across every industry. ALADDIN now controls $21 trillion of our global economy. To put that in perspective, that’s more than the $20 trillion GDP of the US, or the $15 trillion GDP of the entire European Union.

The New Statesman wrote, The total physical cash of all 7 billion people and every company, bank vault, wallet and piggy bank in the world, is around $5 trillion. ALADDIN has grown into a system responsible for more than four times the value of all the money in the world. (01)

This one robot directs the actions of the US Federal Reserve, almost every major bank and investment fund on Wall Street, and over 17,000 traders. It controls half of all ETFs, 17% of the bond market, 10% of the global stock market, and carries out a quarter of a million trades every day and billions of forecasts every week.

Year after year, it hoovers up trillions of data points on every market, every company, every asset and now even each of us, what we buy, sell and say, so that it knows what to buy and what to sell far better than any human being.

Every major bank, company and investment fund has come to rely on ALADDIN, and it’s all powerful AI and algorithms to beat the market. And if they didn’t, they’ve collapsed and failed in ALADDIN’s wake. And you know what the craziest part of this story is? This robot is just getting started, so where did ALADDIN come from and how did it get so powerful? (02)

ALADDIN is (reportedly) the brainchild of Larry Fink, the founder of BlackRock, and its total dominance has made his company the biggest shadow bank in the world, and the most powerful company on earth. (03) (04) (05)

(Note: He also sits on the boards of the Council on Foreign Relations and World Economic Forum, and is all in on the ESG (climate-gender-race) control over the world’s corporations) (06) (07) (08) (09)

The story we’re about to hear is equally unbelievable and terrifying. In fact, you would think it was science fiction if it wasn’t very real and happening today.

This story starts in the 1980s, when Larry Fink was making millions pioneering mortgage-back securities at Wall Street Bank, First Boston Corporation. That’s right, the same mortgage-back securities that caused the 2008 global financial crisis 20 years later. (10) (11)

But back in the 80s, he was in an epic Wall Street rivalry with Lewis Ranieri as Salomon Brothers (now a subsidiary of Citigroup), made famous as a ‘Big Swinging Dick’ in Michael Lewis’ book, Liar’s Poker. (12) (13) (14)

Back then, Larry was making millions for the bank and was on track to be First Boston’s CEO. And then in 1986, an error in the back office computer models led to Larry making the wrong trades and he lost the company $100 million. The result was Larry leaving the bank as a failure with the stupid computer to blame.

With that experience, Larry had just one ambition, to build a super smart robot that could pick out risk and opportunity in the market and do it better than any computer or human could do. In 1988, he launched a new startup BlackRock with a tiny coding team to give birth to this robot.

Its name? ALADDIN. Which stands for Asset, Liability And Debt Derivative Investment Network. (15)

In its first 10 years, ALADDIN was fed information about every asset, price movement, and risk variable in the global bond market, Larry’s specialty. And in 1999, when ALADDIN turned 11, ALADDIN was getting so intelligent at picking losers and winners that Larry began selling access to his data to other Wall Street firms. That same year, he took BlackRock public on the New York Stock Exchange. Straight after the IPO, the dot-com bust burst, pushing a wall of money from the stop market to bonds, which ALADDIN had become the undisputed world champion in. (16)

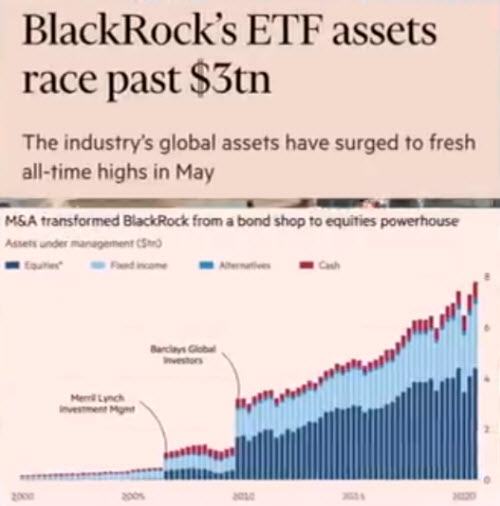

Within years, BlackRock had become a trillion dollar company and has money started shifting back to shares. What did Larry do? He bought the asset management arm of Merrill Lynch, which was focused on shares. (17)

So the gift for ALADDIN’s 18th birthday? All the data points for the entire stock market, and suddenly ALADDIN had a new playground, analyzing every stock trade and risk factor for every company on the stop market. As a result, today BlackRock, together with his two closest rivals, Vanguard and State Street, both of which also rely on ALADDIN’s mountain of knowledge, have become the biggest shareholders of over 40% of all public listed companies in America. (18)

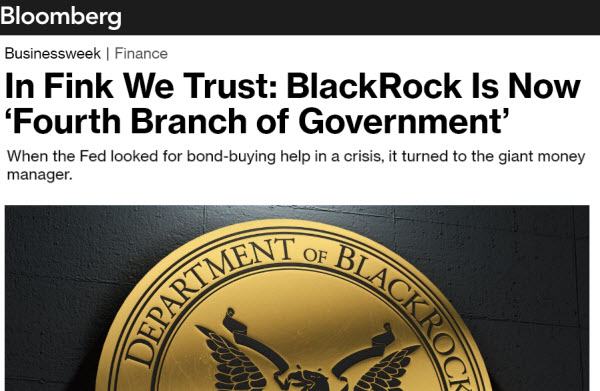

2008, the global financial crisis hit, and before ALADDIN turns 21 years old, is caught on by every Wall Street bank and Timothy Geithner, the head of the Federal Reserve and the US Treasury. (19)

As soon as Lehman Brothers collapsed and the Wall Street meltdown began, the US government came calling to save the next collapsing bank, Bear Stearns. (20) (21) (22) (23)

It was ALADDIN who decided which assets to keep and which to leave in the $30 billion rescue package. And few people know it was a robot that saved America from disaster.

With that first success, the Fed, US government and now even European and Japanese central banks began relying on ALADDIN to make the cause and where the $2.5 trillion of new money they printed should go. The majority of it? Bonds and funding to prop up the mortgage companies and banks. But wait, aren’t these exactly the assets that ALADDIN and BlackRock already were invested in? Exactly. (24)

But growing protests of conflict of interest were drowned out by the noise of the printing presses, printing more money. (25)

As the assets controlled by ALADDIN rapidly grew to $11 trillion by 2013. In the last decade, ALADDIN has gone from the leader to the dominator of all financial markets. (26) (27)

With BlackRock’s Barclays acquisition, it got iShares. Barclays exchange traded funds units or ETFs. And with that, ALADDIN moved from Dominator of Bonds and Equities to Dominator of ETFs, just as all the biggest investors shifted from mutual funds to ETFs. (28) (29) (30) (31) (32)

And that’s when in 2017, everything changed. On ALADDIN’s 29th birthday, Larry launched a top secret project at BlackRock code-named “Monarch”. (33)

Which led to the firing of his fund managers and replacing their funds with ALADDIN’s funds. The robot was now eliminating humans from the equation altogether. And as a result, today over 70% of all trades on US Stock Markets are decided by robots, with ALADDIN leading the way. These trades are completed from beginning to end without a human involved in high-frequency trading far faster than a human can execute.

Now, if this was just a story about a robot taking over the job of Wall Street traders, you might not be so concerned, unless you’re one of those traders. But in the last three years, as ALADDIN hit $20 trillion in assets, incredibly, it has begun to consume and control at an even faster rate.

First, in 2020, as ALADDIN turned 32 years old, the US government and Federal Reserve again came calling as a pandemic hit. ALADDIN was again the one to guide the nation in what was now $4 trillion of newly printed money. Where did the money go this time? Inexplicably, for the first time, the Fed began buying ETFs in 2020. Well, that’s a little strange. And again, the cries of conflict of interest were drowned out by the money printing. (34)

And then, ALADDIN revealed its endgame.

Recently, BlackRock acquired EFront, which collects data on the things that you and I own, including private equity and real estate. And since then, ALADDIN has consumed EFront’s data on the entire global real estate market, and yep, you guess what happened next. (35)

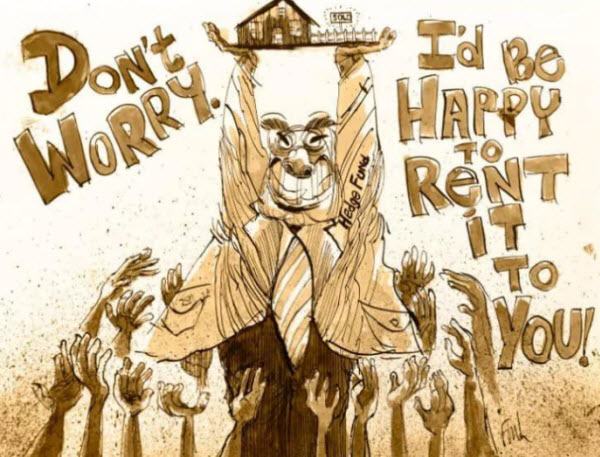

Over the last two years, BlackRock and other funds using ALADDIN’s data have begun buying up single-family homes, where they can afford to out-bed the rest of us as they have unlimited financing at hyper low interest rates. (36) (37) (38) (39) (40) (41) (42)

The result is home prices rising by 20% over the last two years and pushing now even big players like Zillow out of the market. (43) (44)

And here, we see ALADDIN’s endgame, to be the one hyper-intelligent AI robot that not just controls war-street assets, but all assets, public and private. Now, I’m not into conspiracy theories, but even a skeptic with eyes wide open can see the signs.

We’re already at a point where no one can compete without ALADDIN.

As CEOs and asset managers like Anthony Malloy are now saying, “Aladdin is like oxygen. Without it we wouldn’t be able to function”. (45)

And what about government regulation? Well, Joe Biden has appointed BlackRock executive Brian Deese as head of the National Economic Council, which basically means the oversight of ALADDIN and BlackRock is now the responsibility of BlackRock. (46) (47) (48)

And Biden has also appointed BlackRock Chief of Staff, Wally Adeyemo, to be assistant secretary of the Treasury, which means BlackRock is now the Treasury as well as the Treasury Advisor. (49) (50) (51)

And this story is far from over. The genie is out of the bottle, and ALADDIN has already reached a tipping point where one robot controls more wealth than any person or country. But as ALADDIN’s AI capabilities continue to grow, and with this rate of control rising by another trillion to two trillion dollars in new assets every year, it looks inevitable that war-street secret weapon could end up owning everything, and we end up owning nothing.

Posts tagged: BlackRock | Vanguard | Larry Fink

- Why haven’t we heard about BlackRock’s Aladdin?

- Hawaii “Build Back Better” Shenanigans

- Define: Vanguard

- Aussie Banks owned by Vanguard & BlackRock

- Wind Farms Con

- Covid Mismanagement [Senator Roberts]

- Tess Lawrie on Democide: “Mistakes were NOT made!”

- Banking Insider “Why the culling was inevitable” (Austin-Fitts)

- BioNTech Collaborators

- WHO Pandemic Treaty Debate [Senator Gerard Rennick]

- Ohio Toxic Chemical Train Disaster

- NDQ – Shareholders [2/3]

- [Prof Nazar] C19 Vaccine-Bioweapon Genocide (paper & presentation)

- Transhumanism, CBDCs, Nano-Network C19 Shots & the coming Social Credit System

- C19 Vial Contents Summary (Presentation & Paper comparing 26 Labs from 16 countries)

- Ursula von der Leyen

- Dr Robert Malone on who controls the world

- Who Owns the World?

- Young Global Leaders (WEF)

- Tabletop Exercises

Site Notifications/Chat:

- Telegram Post Updates @JourneyToABetterLife (channel)

- Telegram Chatroom @JourneyBetterLifeCHAT (say hi / share info)

- Gettr Post Updates @chesaus (like fakebook)

Videos:

References

![[Comedy/Truth] What FDA is like in their rigorous approval process…(JP Sears)](https://pennybutler.com/wp-content/uploads/2021/11/FDA-777x437.jpg)