[Senator Rennick] Digital Currency, Banking and War

Senator Gerard Rennick gives his reasons for not supporting the Digital Currency Regulation Bill

Regulating a digital currency is a fantasy. 15.11.23

28 Nov 2023 YouTube | Rumble-Mirror | Telegram-Mirror | Hansard | Bill | Web

Transcript:

Senator RENNICK (Queensland): I too won’t be supporting this bill, the Digital Assets (Market Regulation) Bill 2023. (01)

I don’t believe in digital currency—I think it’s a stepping stone to the social licence—and I believe the currency should be controlled by the government of the day. I will stand here and tell you that I do not want the government in the family home, the boardroom, the doctor’s waiting room or the classroom, but there is one thing I do think governments should regulate, and that is the currency.

Digital currencies are used to traffic drugs, to traffic children and to traffic weapons. There is no way that ASIC will ever be able to keep up with the tracking of digital currency. ASIC can’t even do its job properly now. The idea that we are going to regulate digital currency is just a fantasy. We may as well have a market for unicorns and fairies if we’re going to try to regulate it, because that’s all a digital currency is—a world of bytes, a world of make-believe.

If we want to get this country back on its feet, we need to start producing real goods and services. We need to build infrastructure. We need fewer white-collar spivs in their ivory palaces in Sydney and Melbourne. We need more people back on the tools, not trading imaginary figures on a computer screen.

It’s very important that we understand how important controlling currency is. It’s actually one of the reasons why—and I’m one of the few people in this chamber who believe this—the RBA (Reserve Bank of Australia) should come under the control of the Treasurer and should not be independent from government. (02) (03)

I’ll just read out the history of coins in the early colony, because controlling currency is everything. The first colony of modern Australia didn’t really have its own currency for the first 17 years, and, if you want to regulate and control your country, you’ve got to have a currency. This describes currency in the early settlement:

The coins in the pockets of the passengers on the First Fleet were a mixture of currencies from all around the world and included English guineas, shillings and pence, Spanish dollars, Indian rupees and Dutch guilders. It was confusing to try and use these coins to trade because no one knew how much they were worth when compared to each other. This coin confusion meant that other ways of trading were used. People bartered for goods and services with anything they had—food and rum became popular items to trade.

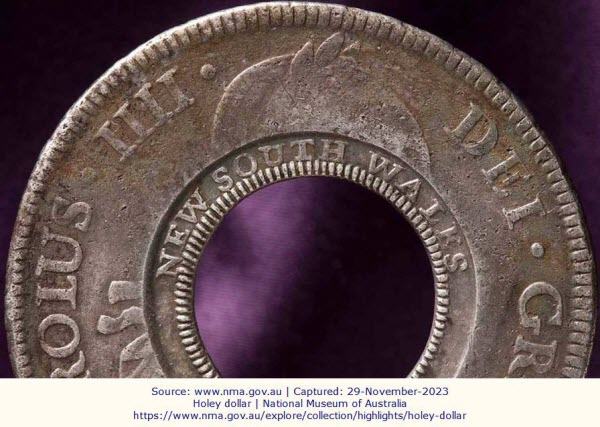

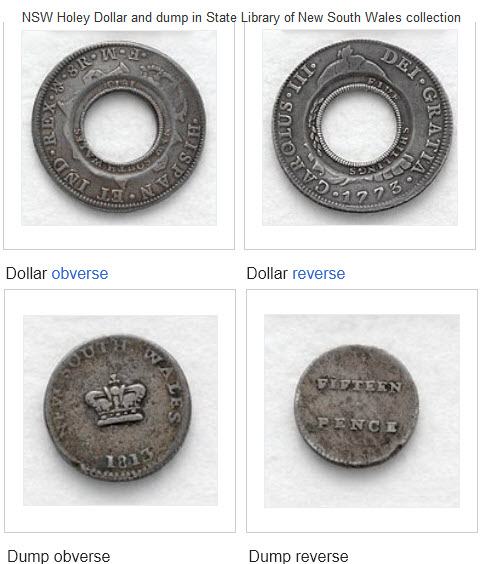

We all know what happened with the Rum Rebellion. It literally went the proverbial up. Luckily enough, we had Lachlan Macquarie, who came along in 1810. He was the first governor to see Australia not as a colony but as a country. He knew that if you wanted to be a good governor for your country you needed a military to defend your borders and provide law and order, you needed a taxation system and you needed a monetary system. (04) (05) (06) (07)

He introduced the Holey dollar, and that holey dollar was used to fund the Sydney Hospital and the Sydney barracks, which still stand in Macquarie Street today. That is what we have to do, as good government involves regulating and controlling your currency. (08) (09)

I want to repeat: when it comes to the government going into your personal lives, I’ll fight that any day. But when it comes to defending the right of the government to control your currency, we have to make sure that that is in the control of the people, because the history of monetary policy is the history of wars.

If we go back to the great patriots of 1776, that was a currency war, believe it or not, because in 1764 the British imposed the Currency Act. That was where they told the American colonies they couldn’t use the Colonial Scrip. (10) (11)

Colonial Scrip – Currency Act of 1764 US Monetary History

As Benjamin Franklin said, that was the reason for the Revolutionary War. If you’re not allowed to use your own scrip, your own paper—let’s not forget that all currency is is an arbitrary construct, whether it’s a digital form of currency or a piece of paper. All that indicates is that you should be able to swap that for something that is tangible. (12) (13) (14)

We’ve got to get back to basics here. If you’re printing this stuff out of thin air, you’ve got to have very tight regulations around it. The British imposed a Currency Act on the American colonies. If you can’t print your own currency, you’ve got to borrow a currency. If you’ve got to borrow a currency, that means you’ve got to pay interest on that currency. Of course, that meant the wealth was going out of the colonies and it was going back to Britain. We saw the same thing happen 200 years later in 1973 with the creation of the petrodollar.

I’ll call it the petrodollar. Most people think the US dollar is owned by the great people of the United States, but that’s not true. The Federal Reserve is privately owned, and when any country uses US dollars they are effectively paying interest to the private banks that own the Federal Reserve. Yet again, I have a problem with that, and I’ll say to my good friends in the United States: take back control of your printing press, because you didn’t realise this in 1913, but those private bankers won the day. So it’s very important that we get this right.

I want to stress it, and I’m going to go through the history now, because it’s very important. We’ll go from the Currency Act and jump a hundred years. The whole history of the United States through the 19th century was all about who was going to control the currency—the private sector and the private banks or the government of the day.

In 1896, a bloke by the name of William Jennings Bryan gave a speech known as the ‘cross of gold’ speech about silver and gold. (15) (16) (17)

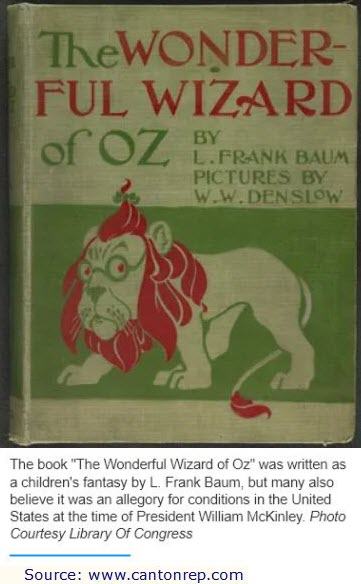

Interestingly, he went up against William McKinley. He lost that election, but he ended up staying in the US Congress and became Secretary of State under Wilson in 1912. Interestingly enough, he became immortalised in a book known as The Wonderful Wizard of Oz: he was actually the lion. ‘William Jennings Bryan’ rhymes with ‘lion’, and The Wonderful Wizard of Oz was a story about the history of monetary policy. Effectively, Dorothy represented the American people, the Tin Man represented the worker and Scarecrow represented the farmer. In the original story, the Yellow Brick Road represented the gold and Dorothy wore silver slippers, not ruby slippers. Emerald City was the colour of the US greenback, and the person behind the curtain, the Wizard of Oz, was the symbol for the central banker. (18) (19) (20) (21)

That’s what we have today, these nasty central bankers that operate in the background, and we know that because in estimate I asked the current governor, the deputy at the time, Michele Bullock, for the minutes between the RBA and the Bank for International Settlements. (22)

If you’ve never heard about the Bank for International Settlements, they are the central banker for central banks.

Bank for International Settlements (BIS) Chief (October 2020):

“with CBDC, the Central Bank will have absolute control“

Michele Bullock wouldn’t give me those minutes. I think it’s a disgrace to refuse that to a senator, a person elected by the people to represent the people. It’s disgraceful that a public and unaccountable independent governor will not give the minutes of those meetings to a senator who wants to share the minutes with the Australian people.

That’s not the only sneaky business the RBA is up to. As I’ve said before, I’ve got the serial numbers and the dates of minting of our gold bars that are held in London, and all those gold bars have been refined since 2014, some as late as 2020.

The reason why the central banks don’t want you to get hold of the gold is that that is a tangible store of wealth. If people ever found out that the real medium of exchange is gold or land, which are hard assets, the stuff that matters because paper deflates away—it’s currently deflating away at seven per cent a year—you would find the people would be up in arms. Trust me, if you look at the Commitments of Traders report—I look at it every Saturday morning to see what’s going on with gold—you will notice that that is also manipulated. Interestingly, as we went through September, the number of shorts held by the banks was decreasing. It decreased right down to the first week of October, and since then it has rapidly increased. I’ll let you guys join the dots on that one. (23)

We’ll jump forward to 1913, when the Federal Reserve was created. It was set up as an independent privately owned bank. (24) (25) (26) (27)

Needless to say what happened after that was that World War I broke out the year after that, and Germany went on to lose that war. They had their bank nationalised after World War I, and the German people were forced to repay the debts from World War I. That led to World War II, and interestingly enough after World War II the Bank of England, which was privately owned, was also nationalised.

I say this to my good British friends: ‘You do realise that you lost World War II. You got shafted because your Bank of England, which should not have been privately owned but was, was nationalised and then the debts from World War II were stuck onto you British people.’ It took them 60 years to repay the debts to the Federal Reserve. That is how the wealth from the Old World went to the New World.

We jump forward, and in 1953 a great US president—probably my favourite, along with Kennedy—gave a speech called the ‘Chance for Peace‘. In the last paragraph he said, ‘We will not be hung on a cross of iron.’ That was his reference to say that all wars are bankers wars. (28)

All Wars are Bankers Wars (a must watch)

We know his speech in 1961 where he called out the military industrial complex and the scientific and technical elite. (29)

He was onto this way back in ’53, and he knew what he was talking about. This bloke commanded D-Day, was head of NATO, was president for eight years and headed Columbia University. If he says there’s a military industrial complex, trust me there is a military industrial complex. It’s interesting that in ’53 he mentioned that same thing.

My point is that the control of the printing press has been fought for for years and years and years, and we cannot let that go into the hands of unnamed operatives who will actually use that. We have issues with ASIC and other watchdogs all the time. This will end up in tears. I read this morning that there are allegations that the current tragedy happening in the Middle East has been funded by cryptocurrency in terms of buying weapons. We cannot allow this stuff to go underground. It’s incredibly dangerous, and it takes our eye off the ball. True wealth is the stuff we see in front of us. It’s the production and capacity to produce goods and services.

If we go back to 1971, they dropped the gold standard in the end. They had to drop the gold standard because of the Vietnam War, when they were printing too much money and couldn’t keep up with gold. Needless to say inflation took off because they were printing money, which does increase demand, but they weren’t using it to increase supply.

This is just like during COVID when we printed $300 billion and paid people to stay at home.

Had we printed $300 billion and used it to build infrastructure, which increases the supply of goods and services, we would not have had this inflation problem and we would have been able to keep people in their jobs and controlled inflation.

It’s interesting. The petrodollar was set up in 1973, and of course the bankers who run the Federal Reserve couldn’t have all the money going to the people selling the oil in the Middle East, so they had to come up with a way to clip the ticket and get the money transferred back to the US. They came up with the petrodollar, which basically is the biggest physical commodity in the world. Of course, the biggest paper commodity in the world is the US treasury bond market.

We’ve been brainwashed. I myself was brainwashed. I knew it was never right, and I’ve spent my whole life trying to get to the bottom of it. We’re not allowed to print money, and I always found that a very difficult thing to understand, because all money is printed. All money is an arbitrary construct; all money comes out of thin air.

The question is: if you are going to print money out of thin air, how do you do it in a responsible manner? The responsible manner, of course, is to match it against an asset that comes out of thin air. The assets that come out of thin air are the rain, the sunlight and the soil. As we know from the words of our national anthem, wealth comes from toil. If we go and farm the land, dam the water and build the power stations to dig up the coal, uranium, gas or whatever, we create wealth from nothing. That is what we must do.

This is the problem with cryptocurrency and digital assets, apart from the social credit that will come along with it later on. There is no security against the hard assets. That is what we must do as a government, and it’s what the RBA must do. They must look at quantitative easing—and that was a recommendation in the 1937 banking royal commission—as a way to stimulate growth in this economy. If we’re going to increase demand by jumping from 20 million people to 26 million people, with another half a million people having come in the last 12 months, we’ve got to increase supply.

The only way we can do that is by tying our currency to hard assets. That is why we need an infrastructure bank in this country that is only for those seven sovereign assets: dams, power stations, road, rail, ports, airports and telecommunications.

I read in the paper just yesterday that the states are saying they don’t have any money to build infrastructure. You don’t need money. If you’re a sovereign country and you have title over all this wealth, you can issue equity. We’ve been brainwashed into thinking that governments can only raise capital by issuing bonds. What’s the biggest market in the world? It’s the US treasury bond market. Where does the US treasury bond market come from? It comes from the Federal Reserve. And who owns the Federal Reserve? It’s the private banks.

So, every time we build a dam in this country—for, say, a billion dollars—and go out and borrow a billion dollars in petrodollars from private banks offshore, the first billion dollars we create in wealth we’ve got to repay offshore. Then they charge us another, say, four per cent interest for another 25 or 50 years. That’s another $1 billion to $2 billion going offshore.

We have to start getting back to producing real goods and services in this country. We’ve got to get those white-collar traders out of those ivory palaces in the big cities and get them back out there building infrastructure. If we go ahead and somehow try to legitimise this digital currency which we will never be able to regulate or keep up with, we are going to a fool’s paradise. We’re going the wrong way. I will be voting against this bill, because we need to get back on the tools, and we need to build this country in the same way our forefathers did.

Posts tagged Senator Gerard Rennick

- [Senator Rennick] Digital Currency, Banking and War

- Australian Senators vs TGA

- Australian Senators vs modeRNA

- Australian Senators vs Pfizer

- [Must See!] Aussie GP – Dr Melissa McCann – Stands up [Part I]

- [Legal] Vax-Injured Class Action – Australia

- Covid-19 Military Operation [Katherine Watt]

- WHO Pandemic Treaty Debate [Senator Gerard Rennick]

- TGA FOI 2389 – BigPharma & TGA Conflict$

- TGA FOI 2389 – Ingredients, Dosage, Manufacturing

- TGA FOI 2389 – No Benefit

- TGA FOI 2389 – Safety Studies Skipped

- TGA FOI 2389 – Spike protein in any cell in the body

- TGA FOI 2389 [Video & Doc]

- Australia Records Highest Excess Deaths since WWII

- [Senator Rennick] Health advice never mandated jabs in the workplace

- Dr John Campbell on Australian Senators Ralph Babet & Gerard Rennick

- Debating fake AI bots about Australian Politicians

- Senators Try to Wake Up the Corrupt Hive-Mind we call ‘the government’

- Australian Jab Update – Miscarriages & Serious Injuries

Site Notifications/Chat:

- Telegram Post Updates @JourneyToABetterLife (channel)

- Telegram Chatroom @JourneyBetterLifeCHAT (say hi / share info)

- Gettr Post Updates @chesaus (like fakebook)

Videos:

References